4 Invoicing Tips to Help You Get Paid Faster

- Carol Kok

- Jul 31, 2017

- 2 min read

Cash flow is a very important topic in every business, and the success of your business often relies on you getting paid on time. In order to get paid, you will need to issue an invoice and invoicing should not be seen as a back-office administrative nuisance. Rather, it is a vital first step in achieving healthy cashflow.

1. Send Your Invoice ASAP

Once your client has confirmed your quotation, or as soon as service is rendered, you should invoice your client immediately. This reminds your client that work is completed and payment is the final step, a good practice which found to results in immediate payment. The fastest way to make sure your invoice reach your client will be by email.

2. Get Your Invoice Details Right

Make sure you have get the correct company details, delivery date and location, customer purchase order number, clear description of the goods or services supplied, payment terms, accurate quantities, prices, discount (if any), GST and total amount due so that they can proceed to prepare payment without changes and delay.

3. Negotiate Clear Payment Terms Upfront

It's important you have a written agreement with your client on your payment terms and deadlines. This make sure you and your client have mutual agreement on how and when your client need to pay. You should clearly emphasises the payment terms on every invoices, such as "Cash on Delivery (COD)" or "Net 30" if you expect them to pay in full amount within 30 days from invoice date.

4. Review Pending Clients Payment Regularly

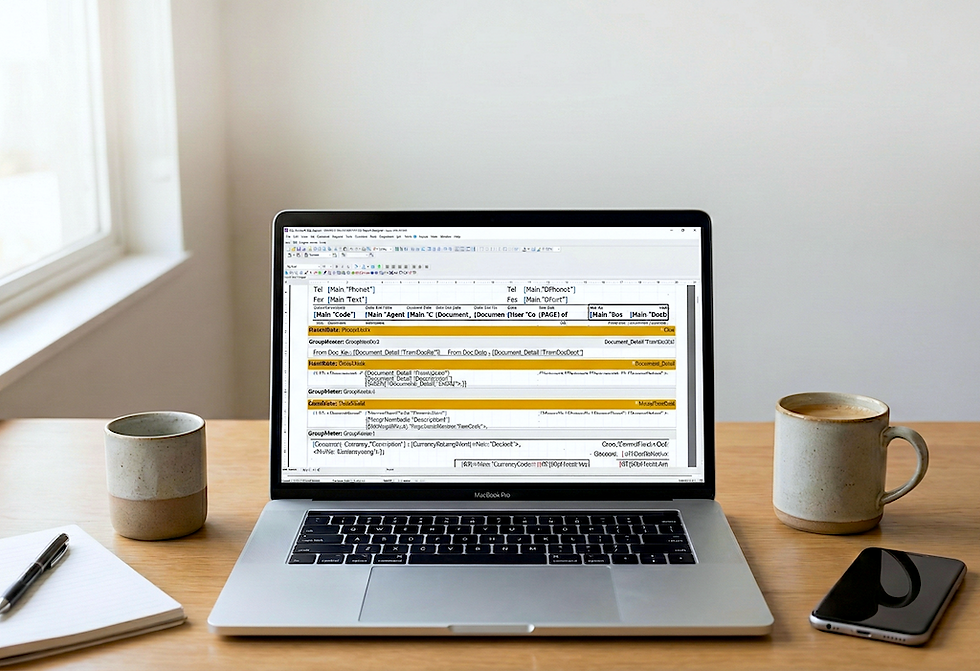

It's normal to have a few clients that don't pay on time here and there, but if the majority of your clients are skipping payments or paying late, then the problem is with your "payment system". You should keep track of your invoices closely and monitor any late payment behaviour so you can catch any flaws sooner. The best way to track that is with your account receivable aging report to determine which clients have not paid and when they are due to pay.

It's never fun to track invoicing and payments but it is necessary to maintain an effective and healthy finance of the business. Besides, your business does not run on good will so make sure you have done your part professionally and don't forget or be afraid to remind them of the payment.

Comments