5 Reports Every Business Owner Should Review in SQL Account

- Carol Kok

- Aug 7, 2017

- 3 min read

As a business owner, it is important to review your business performance as it will allow you to effectively run your business, enable you to better analyse operations, and help guide business decisions.

Get into the habit of taking a short time each morning to review your business daily, weekly and monthly reports. It increases your chances of meeting your targets and highlight potential areas of concern.

To help you out on which reports to run in SQL Account, let me suggest my top 5.

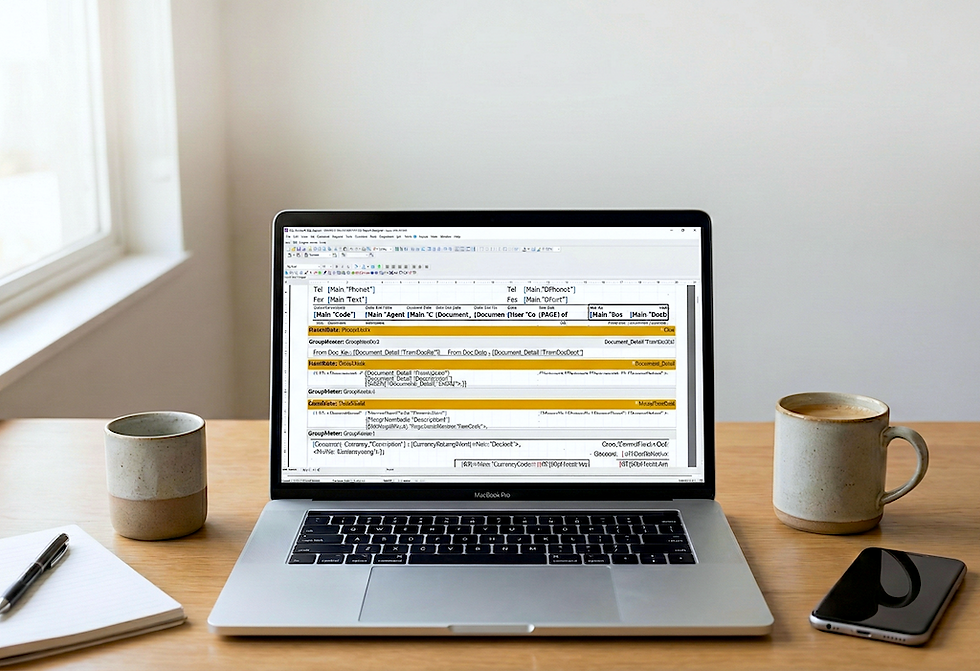

1. Print Sales Document Listing

This report is able to show you the productivity of your sales team, and whether the team is meeting their targets and daily goals. It gives you a picture of how many leads and quotations have been generated, which quotation is accepted by your potential customer and invoices that your company send out. You should run this report daily. It keeps you on your track and analyse details your sales history.

It also tells you who your most important customers are — the ones who spend the most money! Learn who these customers are to be sure you are giving them excellent customer service.

2. Print Outstanding Sales Document Listing

Think of this report as a To-Do-List. It allows you to track what are the pending quotes, sales orders, delivery order and invoices. It's great when you need to get the latest sales status to have a conversation or briefing with your salespersons in meeting.

It also gives you a birds-eye-view to maintain your operation in order, making sure all confirmations gets delivered on promised time, which items are still waiting for supplier shipment, and which fulfilled orders are still pending for invoicing. After all, it all relates to maintaining profitable customer relationships ensuring your customer is satisfied with your prompt actions, goods and services.

3. Print Customer Aging Report

Also called Accounts Receivable (A/R) Aging Report, it shows outstanding customer in column based on the agreed payment terms, typically current, 1-30, 31-60, 61-90 and >90 days overdue. A common source of cash flow problems (especially for SME businesses) is poorly managed accounts receivable. The more cash you have tied up in receivables, the less cash you have available for running your business.

Reviewing the Customer Aging Report will help companies proactively manage the customer collections process immediately upon invoicing and create more accountability for the person responsible for collections.

4. Print Cash Flow Statement

This report is gold for the business owner. It shows you all cash inflows and cash outflows of your business over a period of time. The cash flow statement is different from Profit and Loss Statement and Customer Aging Report as it only reports all the cash activity. Presented in three sections: operating, financing and investing activities, it indicates which areas of the business are generating and using the most cash.

If this report shows a negative, it will give you all the more reason to use the Customer Aging Report from above to identify those customers that falls out of the agreed payment terms and call them to get the money in ASAP. Cash Flow Statement is also best used to estimate future cash flows which will assist in budgeting and decision making.

5. Print Profit and Loss Statement

The Profit and Loss Statement summarise the total revenues and expenses incurred by the business, most importantly showing the profitability (net income or net loss) you have made over a specified period of time, usually a month, quarter or year.

Drilling down into this report will show you where your revenues and expenses are coming from. Pay close attention on every line of this report, you might be able to spot small improvements that can ultimately lead to greater profitability.

Running reports in SQL Account is easy. All you need to do is just a simple click anytime you need.

Comments