Realize your goals and reach success with budget planning.

- Carol Kok

- May 4, 2017

- 3 min read

Every start of a new year, every business owner including you will decide that this year you want to have more revenue growth in your business. You want to hit $100,000 in revenues, or maybe $300,000, $500,000 or even $1,000,000.

But, how will you reach your goal?

You need to create a plan, and the first step of the plan is a budget.

It is important that you prepare a budget for your business every year. Regardless of how large or small your business is, a budget is the one thing that will help you gauge growth and profitability in your business.

Here are a few reasons why a budget is important for success in your business:

Creates a structure

With a budget plan, you can tell how much money you plan to make and what you plan to spend it on. It is the financial tool needed to help you reach your goals. A budget displays your expected results numerically. By documenting it, you can see in black and white whether your goals are realistic and achievable.

The budget will be the basis for everything you do in the upcoming year. It will help you determine what your pricing needs to be for your products & services, it will also help you determine what you can expect to spend on marketing costs that will generate leads. And, it will help you ensure that your offerings generate a profit.

Keeps you focused on your money goals

Because you are aware of the numbers you expect to generate and spend, you are more inclined to monitor and track them on a consistent basis. You avoid spending unnecessarily on items and services that do not contribute to meet your financial goals. Having them constantly in your face ensures that your goals are met and your business is operating, as planned.

Saves you money for expected & unexpected cost

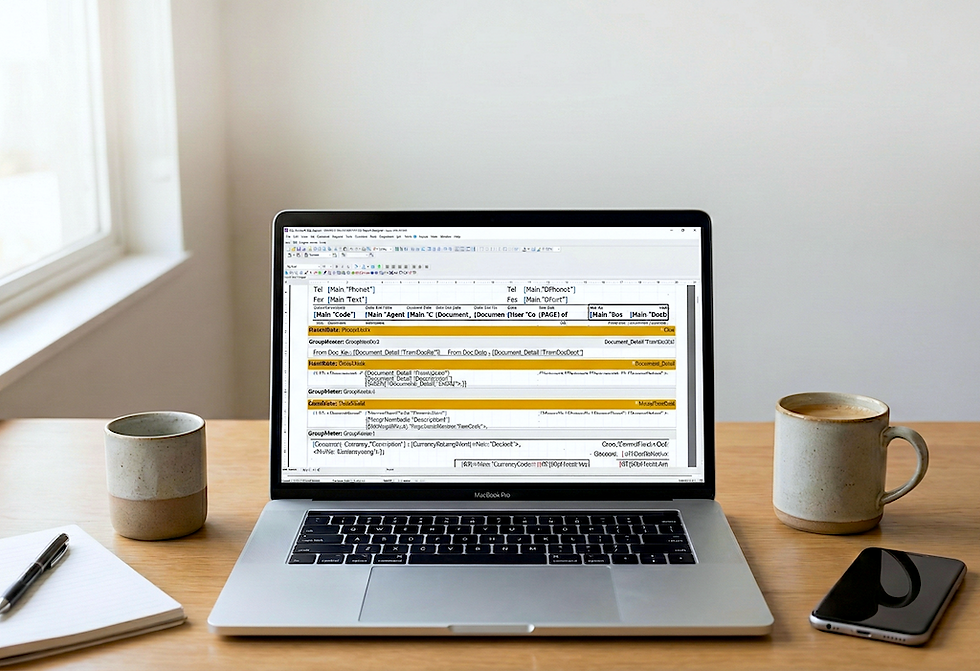

Having a budget prevents you from overspending. When you input your budget into an accounting system, such as SQL Account, MYOB or Quickbooks you will be able to track how much you are spending in your business in actual, compared to your budgeted plan. Without a budget, you are more likely to spend money whenever and wherever. The result of these actions can lead to unmanaged cost and short in cash flow.

Early warning for potential problems

Having a budget enables you to control your spending over what you need to spend to create your products, services and overhead expenses. List out all your expenses actually forces you to take a hard look at the things you are paying for and highlight costs that you may not really need, or could find an alternative vendor source for.

Helps make better business decisions

Having a budget in place ensures that you monitor your numbers regularly. It puts you in tune with your sales and your costs associated with these sales, as well as your marketing, payroll, inventory, fixed assets and cash flow, all of which are needed to keep the business going. Knowing your numbers allows you to make informed managerial decisions based on solid facts, not fabricated ones. With a budget in place as a starting point, you will be able to adjust future months, as needed, to ensure that you still meet your overall goal.

Your budget will include a detailed breakdown of each revenue stream in your business, and what percentage of your revenue it generates. It will also have a detailed breakdown of the costs your business will incur, and the months you expect them to occur in.

Comments