When Do You Need To Change Your Existing Accounting Software?

- Carol Kok

- Jul 13, 2017

- 2 min read

If you're reading this article, I assume you already have an accounting software and also looking for a replacement accounting software for your business. While "if it ain't broken, don't fix it" has seems to workout for some time, the truth is you're not getting any further due to the fear and concern associated with making a change to what you already been so used to. Plus, maintaining an outdated or improper accounting solution will cost you even more impacting your business and weights you down on competition.

Below, let me remind you what are the possible cost involved.

Your accounting software is ancient.

Given how quickly technology changes today, it is important to make sure your accounting system is up-to-date, running latest version on the latest Windows. But if you're maintaining an outdated software, you depend so much on your old software and the PC running it that you worry one day it might crash with all your business data gone.

You're paying expensive yearly licensing fees.

If you're paying expensive yearly support & licensing fees to maintain use of the accounting system, chances are that you might be paying too much for features that can be fulfilled far more cheaply by other accounting software today. Besides, you could be paying features that you will never use in your business too.

You're losing sales to your competitors.

Say you have the best product in the market, but you're holding on to an accounting software with limited functionality and endless wait. As a result of relying on the old technology, you can't respond to your customer faster & accurately by sending them the required quotes or pricing information, it is likely they might get someone else or never come back.

You're maintaining a snowball of accounting mess.

Due to lack of access control in your existing accounting software, everyone maintain their own style in the system rather than having a standard ones. And often, what's history remains mystery and you can't make any reversible actions to remove it. A lot of times this happen when you are dealing with inventory, you're pretty sure you've seen the stock somewhere in the warehouse but your system tells you have negative stock.

Your accounting software is increasing your workload rather than reducing it.

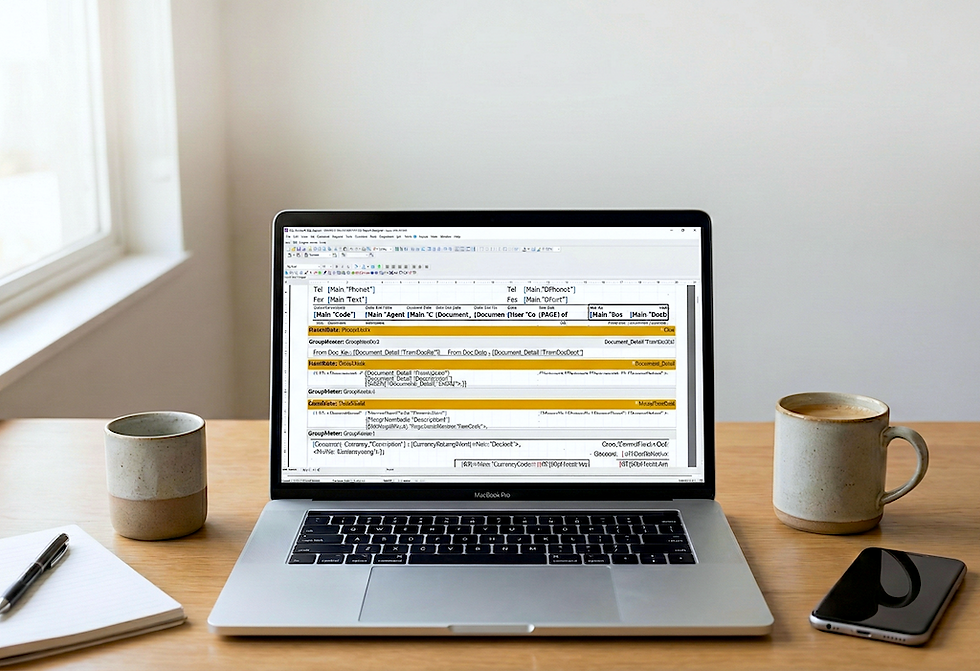

A good accounting software should allow you to execute things faster, smarter, and precisely than using any other traditional methods - such as the ability to convert quotation to invoice, real-time updates on stock orders & balances, searches for price history, allow your salesperson to work remotely, and watch all incoming data waiting to be analysed to give you a better grip on the business growth.

Comments