Avoid These Common Small Business Mistakes

- Carol Kok

- Mar 24, 2017

- 3 min read

Having your own business is definitely exciting. When you first start up, you are passionate, energetic and have dreams of making the big time. But as time goes on, you may discover that although you have the passion, the energy runs out quickly when each day provides the next challenge.

Don’t let these common mistakes drag you down. Avoid them, and get your business back on track.

Failing to plan

Quote by Benjamin Franklin: “If you fail to plan, you plan to fail!”

This is a big problem for many small businesses. If you don’t have goals and specific plans on how to get the business where it needs to be, you will be distracted by every detour along the road and your business may end up nowhere.

Spend a day at the beginning of each year setting out your goals and plans. It doesn’t have to be pages long. Try to put your goals all in one page and pin it above your desk or sticky note on your laptop so you can refer to it regularly.

Not understanding cash flow

Always remember, cash is king. Many business fails when they run out of cash.

Most business owners focus on sales and profits, but cash flow is critical to the success of your business. Many profitable business still struggle with cash flow. You need to understand the difference between profit and cash, and focus on ensuring you have adequate reserves to cover the unexpected.

Taking your eyes off marketing

Start a business and you will have customer sooner or later? No, that's not right.

Just because we feel that we have the best products and services to solve the customers' problems does not necessarily mean they are aware of their problem — or know you have the solution.

There is no guarantee sales will happen if you open a business. You need to stay on your marketing toes at all times to keep a steady stream of customers visiting your business or aware of your business presence.

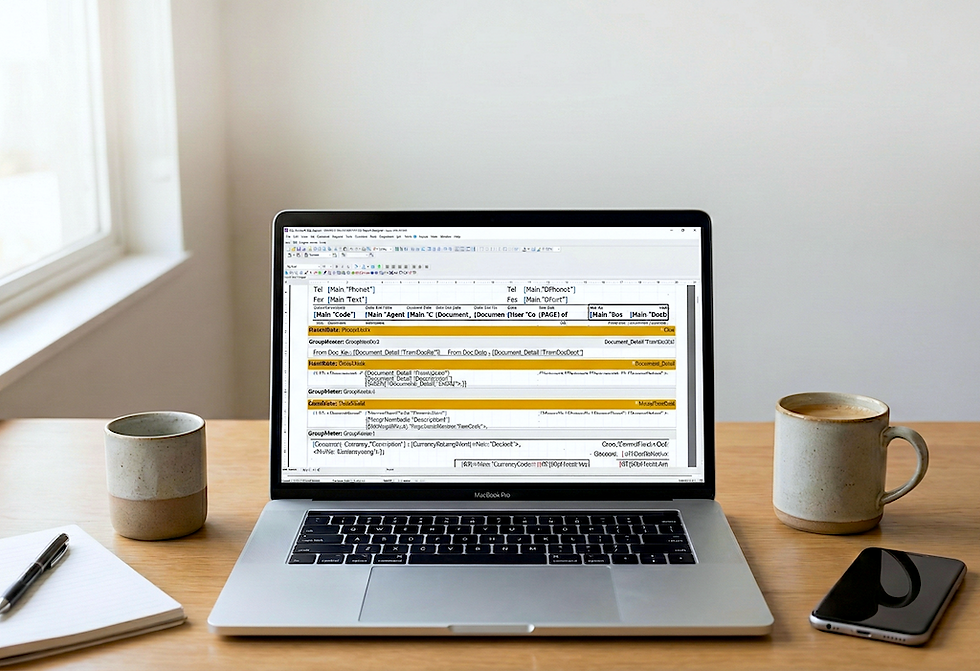

Rely on convenience

Convenience is generally seen as a good thing, but at some of point time it might cost you more inconvenience in the end.

Many small businesses use spreadsheets to keep their financial, customer and key business records. Although this might suffice at the beginning, once the business is up and running, you need specialist software that will ensure all the information you record is correct and accurate.

Spreadsheets are prone to errors. There are no built-in controls over the information entered, and spreadsheets will not provide critical information in a decision-making format without an enormous amount of time and effort.

Use tools that are specifically designed for record keeping and deliver reports and key performance measures on demand — it will make your life easier and ultimately improve your business.

Being a jack-of-all-trades

One of the most common issues for business owners is time, you wish you had 48 hours a day.

You have to be the marketer, sales representative, product development expert, finance manager and another half-dozen different roles. Budgets are tight and you can't afford to hire people. It's might work well in the beginning but as you grow, you can't be an expert at everything.

Evaluate where you spend your time and effort. If it is better spent working towards your primary business goals and recognise that you may not be a specialist in finance and marketing, hire the right people to help you or consider outsourcing some tasks.

Comments