Does Small Business Need An Accounting Software?

- Carol Kok

- Mar 16, 2017

- 2 min read

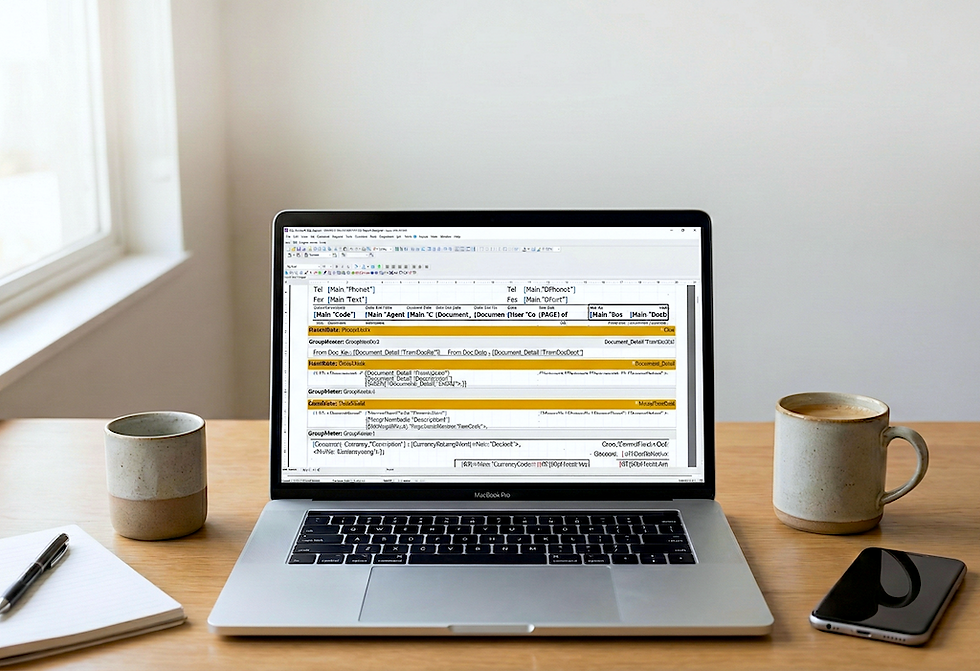

In Singapore, 99% of businesses are SMEs and while large corporations might have impressive finance department, your business have only a handful of helpers, some have none. So it's important to work smarter by getting an accounting software to simplify data entry, organise information, provide reports, and allow business owners more access to important financial information about many aspects of the business. After all, it's not as complicated as you think with the user friendly interface in accounting software nowadays.

Here are 5 reasons why your business should have an accounting software:

Speed for Productivity

Most of the companies I came across start with excel spreadsheets, yes flexible and easy to use. But when they get an accounting software, they actually process their accounts at a greater speed than what they used to be in excels. Thanks to the automation feature in accounting software that helps increase productivity. For example, recording a sales invoice also automatically update your sales report, debtors aging report, your GST report, profit & loss report and balance sheet report instantly, rather than having someone to update each of the reports manually.

Centralisation

We all want conveniences. For business owners working with a team, you will be able to give managers, salespersons, accounts, or storekeepers access to the accounting software so they can deal with tasks such as invoicing, inventory management, purchasing and better customer relation management too. When informations are centralised, everyone can save time and trouble to deliver their task.

Get to Know More of Your Business

Having an accounting software is like having an in-house financial advisor. The analysis reports allow you to analyse different aspects of your small business, providing the data you need to make better financial decisions. Reports such as Monthly Profit & Loss show exactly how well your business is doing that month while reports such as Customer Aging Detail shows all of your customer dues with the given terms so you can track easily.

Simplifies GST Reporting

Besides keeping records how much tax you have collected on your sales invoices, accounting software also allows you to prepare reports showing how much tax your business has paid quarterly. Some accounting software even helps you prepare GST F5 Return which is even much better by gathering the figures to reported under different boxes. This allows you to calculate GST Return itself semi-automatically, rather than spending time and resources working out the necessary details by hand.

Security

No matter you are a large or small business, having valuable data on your company fall in the wrong hands can jeopardise all your business efforts. It is important to keep sensitive information safe and secure with the access rights control that is built-in to your accounting software.

Comments